Portfolio: Sample Projects and Products

Delivered projects spanning AI platforms, operational automation, and marketplace products

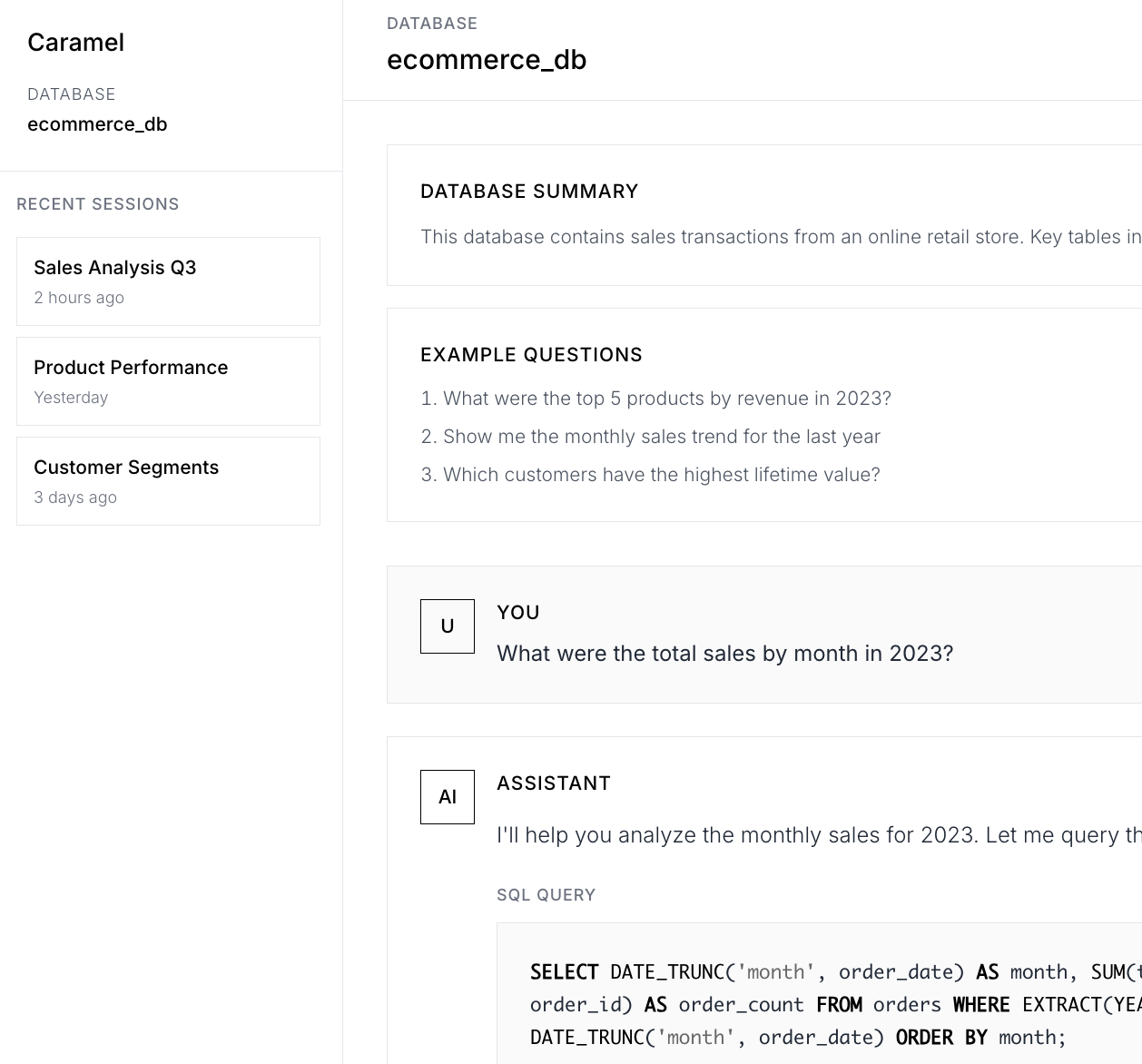

Caramel - Natural Language Database Analytics Platform

Data analytics tool enabling any user to query any databases through natural language with no SQL or schema knowledge required.

- 13-agent multi-agent LLM workflow to manage context and improve performance and accuracy

- Intuitive workflow integration to provide users with answers and an elegant fall-back workflow

- Role: Startup with two others. Built out the product and business model with an experienced semi-conductor software engineer and a transport technology entrepreneur. We built a decent product, received initial and then follow-on grants from Microsoft. and had some early discussions with notable enteprise customers.

After evaluating the requirements and accreditations required to sell into the enterprise channel we ultimately felt this opportunity would be captured better by more established competitors.

Problem/ Opportunity

Most business users have questions about their data but lack technical SQL skills, knowledge about the schema, data labelling conventions and unique business lingo. They either get bottlenecked asking a data analyst, attempt to learn SQL (but then are still stuck because they can't navigate the schema), or never get the insights they need.

Solution

Users ask questions in plain English to Caramel via a Slack Bot UI ("Show me top customers by revenue last quarter") and receive answers with breakdowns and visualisations. If Caramel can't provide an answer with confidence, it will do the initial leg work, provide its best guess and package this info up in a jira ticket for a data analyst to review.

Technical Architecture

Multi-Agent AI System (13 Agents)

Planning Layer:

- UserInteractionAgent: Entry point, query classification

- GeneralAgent: Handles non-database queries

- ApproachPlannerAgent: High-level strategy

- ExecutionPlannerAgent: Detailed execution planning

- TaskPlannerAgent: Task breakdown and sequencing

Intelligence Layer:

- SchemaMetadataAgent: Database introspection and schema analysis

- SemanticSearchNode: Vector-based schema matching

- SchemaRetrievalNode: Detailed schema fetch for relevant tables

- TableSelectionAgent: Filters to most relevant tables

Execution Layer:

- SQLGenerationAgent: SQL query creation

- SQLReviewerAgent: Logic validation

- SQLVerificationNode: Syntax and safety checks

- SQLExecutionNode: Safe query execution

Recovery Layer:

- ErrorHandlerAgent: Graceful error handling and user feedback

Key Innovations

1. Practical operational implementation workflows

Almost every enterprise data analytics platform is trying to build perfectly accurate natural language to SQL. Best benchmark scores (Spider 2.0) are ~ 60% accuracy for complex queries. Smart human-in-the-loop and fallback workflows still needed.

Caramel is accessed via a Slack Bot. The user pings the bot like they would a question to a data analyst. The bot will go back and forth to confirm user intent and then go off and try find an answer. This async workflow is meant to free us from needing to focus too much on latency issues. Caramel will take its time and ping the user back on slack when they have the answer, similar to what you'd expect when speaking to a real human (not to wait and get an answer immediately).

If Caramel can't answer with confidence it packages up the initial discovery work and puts it in a Jira ticket for a data analyst to review. This human-in-the-loop feedback can then be used by Caramel next time meaning its speed, accuracy and usefulness improves within an organisation over time.

2. Business model innovation

As mentioned, almost all enterprise data analytics platforms are trying to build out natural language to SQL functionality. Even if they do nail it, it still doesn't solve the problem of empowering and democratising data insights for the whole org, since these enterprise tools sell expensive licences on a 'per seat' basis.

If you are a casual consumer of data insights, it is unlikely your company will pay for your monthly licence. Caramel aimed to commercialise with a 'charge per successful query' model. Demonstrable ROI for businesses, and potentially an extremely profitable model for Caramel, since as it learnt the companies data schema over time it could serve up historical common queries at greater speed, higher accuracy and lower cost since it wouldn't need to ping the series of external LLMs each time.

3. Dynamic LLM Model Selection

Cost and accuracy optimised model routing based on task complexity:

- SQL Generation: OpenAI O3 (highest reasoning - expensive, slow and most accurate model at the time)

- SQL Review: O4-mini (cost-effective)

- Table Selection: GPT-4.1-nano (cheap)

- Classification: GPT-4o-mini (balanced)

Other features

- Real-time progress updates: Users see what's happening (transparency builds trust)

- Chart auto-detection: System picks the right visualisation (line/bar/pie etc.) based on data

- Safety first: Users can never accidentally (or maliciously) delete or modify data. Org permissions naturally inherited via the org's user roles and logins.

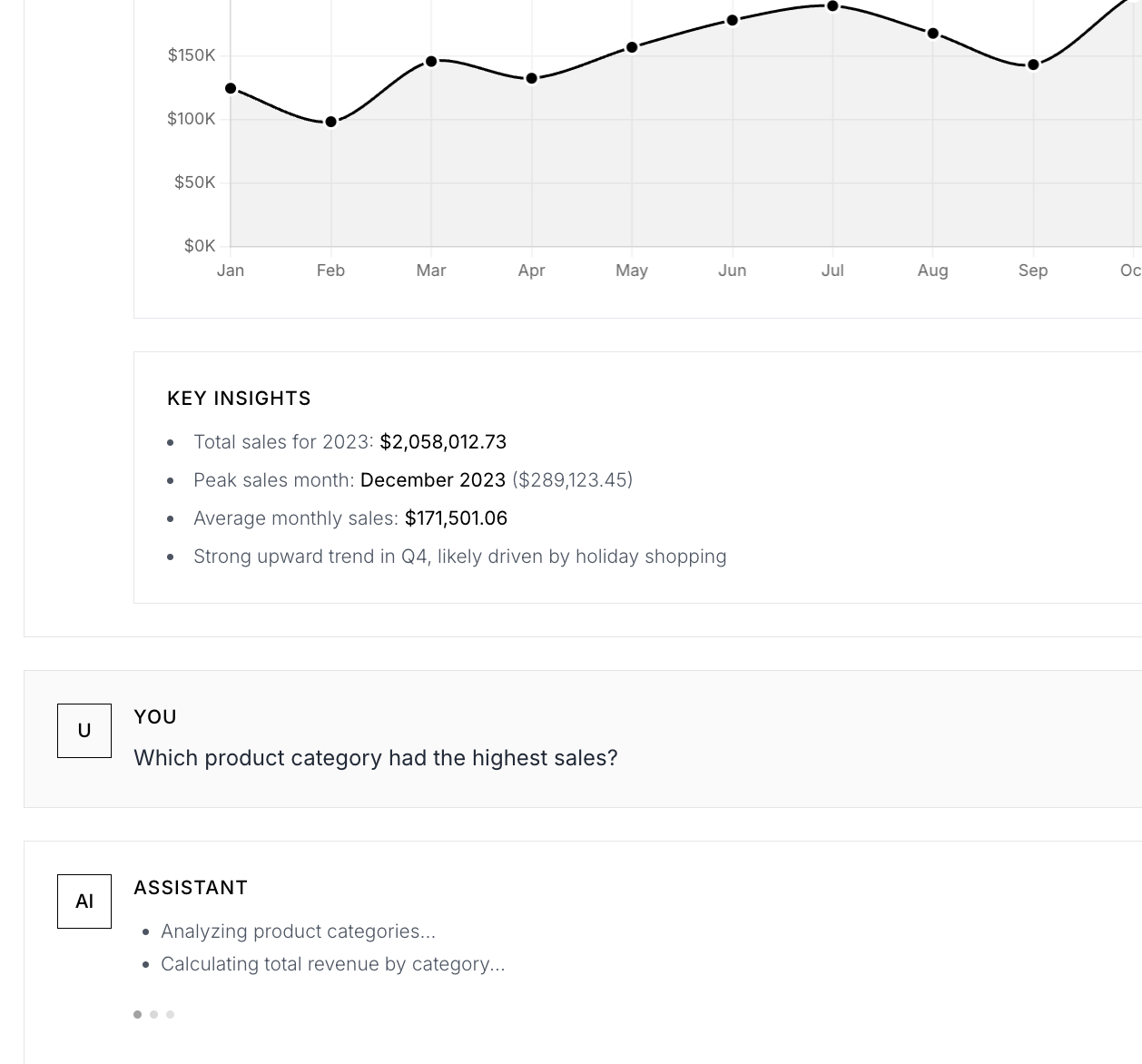

Product Screenshots

Examples of Caramel in action - SQL query generation and data visualisation with insights

Natural language to SQL query generation - web portal version shown.

Chart generation with insights and analysis

Treasury Operations Automation - (ASX-listed fintech)

Automated manual treasury operations saving 1,000+ hours annually with 100% uptime in production for 3+ years (and counting I believe).

- 1,000+ hours saved annually (3,000+ hours over 3 years in production)

- 100% uptime during tenure.

- API-driven middleware architecture future proofed solution and offered vendor choice flexibility

- Role: Lead the initiative (discovery, strategy, solution design and execution). C-Suite stakeholder management (CFO, CTO).

Problem/ Opportunity

Prospa's finance team had 3-4 senior controllers logging on every single business day at 4pm (even on holidays) to spend an hour manually processing payments.

- Export CSVs, human checks, double-checks with colleagues, sign-offs

- Upload to bank web portals manually

- Batch process occurring once per day meant customers could wait 72+ hours to receive funds over weekend.

- Process hadn't changed since early days of the business

Solution

API-Driven Payment Middleware

- Workflows and validations happen on our end

- Payment vendor can be swapped out if needed (future-proof)

- Modular architecture allowed parallel testing alongside old process

- Started with lowest-risk payment types, gradually rolled out to highest-value/frequency

Approach

- Chunked it down: Delivered treasury automation FIRST before touching instant payments (faster time to value, build momentum)

- Built middleware in production: Running parallel to old process (proof it works)

- Retained manual process as fallback: De-risked the change

- Led payment vendor due diligence: Considered all non-obvious factors (float requirements, roadmap alignment)

- Built foundational infrastructure for instant payments (strategic win beyond just efficiency)

- Finance team don't need to bring laptops on annual leave to process payments anymore

Healthcare Marketplace Platform - T-Shirt Ventures

Built foundation features for a marketplace connecting individuals with healthcare providers in Australia's NDIS industry.

- Two sided marketplace - Customer portal + Provider portal

- Industry unique payment and billing - required unique marketplace fee structure and billing approach

- Matching system - Pairs individuals with appropriate providers based on needs, location, availability

- Demand discovery features - Educational tools to showcase services on offer.

- Role - Product manager leading this marketplace initiative alongside a designer and team of developers.

What we Built

Dual-Portal Architecture:

- Customer portal: Service requests, provider matching, appointment management

- Provider portal: Request triage, case management, client communication

The Regulatory Challenge

NDIS has unique attributes:

- Multiple user roles - participant receiving services, parent, support coordinator etc.

- Billing and invoicing

- Service type rules and eligibility

Self-Serve Digital Refinance Application - Prospa

Built end-to-end digital self-serve refinance journey with automated credit decisioning. Customer's could self serve at their convenience rather than calling in during business hours.

- Automated credit decisioning - Real-time assessment replacing manual review process

- Seamless user experience - Guided application flow with smart validation, happy path and non-happy path processes.

- Integration with core systems - Credit decision engine, identity verification, CRM

- Role: Product Lead - Discovery, design, delivery and post-launch optimisation

The Problem

Existing customers wanting to refinance their loans faced a multi-day manual process:

- Had to contact sales team during business hours

- Submit documents via email

- Wait for manual credit assessment

- Potential to loose customers if they were waiting around and enquired with competitors

The Solution

Self-Serve Digital Application Platform

- 24/7 access to extend line of credit term

- Automated credit decisioning engine providing instant approval/decline, or a graceful fallback to an optimised human-in-the-loop process

- Real-time status updates or ability to pause and resume loan application later

- Seamless handoff to next workflow for funding if approved

Key Features

Guided Application Flow:

- Progressive disclosure - only ask for information when needed. Since these were existing customers we already had a lot of data. Customers didn't re-enter unneccessary info

- Smart defaults pre-populated from customer history so customer could quickly check off things that may have changed

- Contextual help and validation at each step

- Save and resume functionality

Automated Credit Decisioning:

- Integration with credit scoring engine - required collaboration with that core service team to expose a new endpoint to meet our unique requirements

- Graceful fallback to human review when required with clear communication, next steps and SLAs

Document Management:

- If approved, render the appropriate contract template in-app with docuSign functionality

- Workflow if customer needed to request changes to the contract

- Push completed doc to CRM if signed and progress user to next path

Identity Infrastructure Implementation - Fintech

Implemented enterprise identity infrastructure using IdentityServer. A foundational requirement for building out customer and broker portals

- Role: Product Manager - Requirements definition, design of user flows, implementation oversight

Results

- Foundational infrustructure for customer and broker portal build-out

- Well documented and flexible enough to meet future evolving use cases

- Centralised identity management - Single source of truth for user authentication across digital products and portals

- OAuth 2.0 & OpenID Connect - Industry-standard protocols for secure authentication

- Related login user flows - Login, reset password, 2FA, appropriate redirects

Additional Projects - Self-Developed

Extensive use and experimentation with Claude Code to build functioning products, prototypes and experiments.

- Giro - E-Ink Dashboard Server

- JuGu - Local Private LLM RAG Knowledge Base

- Club Vino - Restaurant Wine Pairing Recommendations

- Sparkey - Risk Management Tool

Projects Built

Giro - E-Ink Dashboard Server

Technical Implementation:

- Backend server handling device connections and data aggregation

- API endpoints optimised for e-ink refresh rates and limitations

- Dashboard configuration portal to edit displays and configure settings

Use Case: Personal dashboard displays for office or home showing key metrics, weather, calendar, or business KPIs on energy-efficient e-ink screens.

JuGu - Local Private LLM RAG Knowledge Base

Problem: Difficulty managing and querying information accumulated from web research while maintaining privacy and avoiding cloud LLM costs.

Solution: Local private LLM with RAG knowledge base plus headless web crawler. Scrapes web data, stores it locally, and makes it available to a privately-hosted LLM.

Technical Implementation:

- Headless web crawler for automated data collection

- Local vector database for semantic search

- RAG pipeline integrating crawled content with LLM queries

- Private LLM deployment (avoiding cloud dependencies)

- Content processing and chunking for optimal retrieval

- Simple chat UI interface for natural language querying of scraped data

Club Vino - Restaurant Wine Pairing Recommendations

Problem: Restaurant diners struggle to choose wine pairings without sommelier expertise, while restaurants can't afford full-time sommeliers.

Solution: Restaurants upload their menus (wine & food), then offer customers personalised recommendations adherent to sommelier best practices. Customers access via QR code on wine menu.

Technical Implementation:

- LLM-powered recommendation engine using sommelier pairing principles and incorporating user-imputed preferances including budget

- QR code generation and scanning for customer access

- Mobile optimised web-app UI

- Recommendations ranked by pairing rank score with explanations

Sparkey - Risk Management Tool

Problem: Decision-makers lack structured frameworks for sizing bets in uncertain environments (marketing spend, investment allocation, time or resource commitment to a certain initiative).

Solution: Risk management tool applying volatility and conviction-adjusted portfolio theory to marketing, investment and business decisions.

Technical Implementation:

- Risk-reward calculation

- Volatility adjustment depending on stability (more stable = larger bet)

- Performance based scaling - increase risk tolerance if recent performance is good

- Scenario analysis and sensitivity testing

- Decision tracking and outcome monitoring